If this information is correct, Arbitrum will hit $2 soon

[ad_1]

Arbitrum (ARB) just recently broke above a key resistance level. This incident suggests that the token price may continue to rise.

So, let’s take a closer look at ARB’s on-chain and market indicators to see if investors should expect ARB to hit the $2 mark anytime soon.

Arbitrum’s Price Action Looks Ambitious

expert cryptocurrency Tony just posted a post on X (formerly Twitter) highlighting that ARB has broken through a key resistance level. According to the tweet, ARB has crossed the $1.07 mark.

This is the first time since mid-August 2023 and signals hopes for ARB to continue rising in the coming days.

We need a resistance zone $ARB / #arbitration Closed to confirm ARB season pic.twitter.com/r3gW2Izhh4

— CryptoTony (@CryptoTony__) November 4, 2023

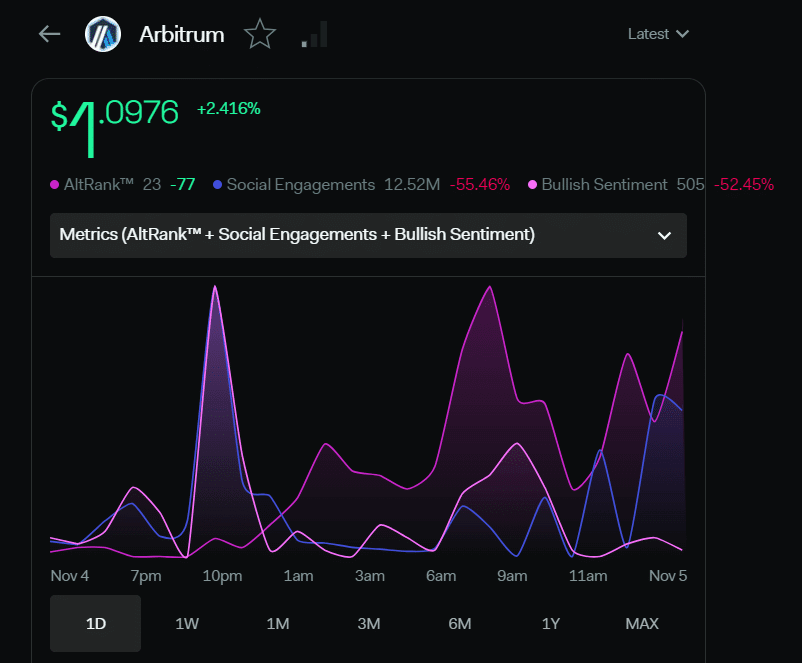

Data comes from coin market cap Indicates that ARB prices are rising. The token’s value has increased by more than 2% in the past 24 hours.

As of this writing, ARB is trading at $1.10, with a total market capitalization of over $1.39 billion. This could make it possible for ARB to hit $2. However, when looking closer, we see a different story.

While ARB price increased, trading volume decreased, indicating that investors did not want to trade the token. Market sentiment on Arbitrum has also turned negative, with bullish sentiment falling by more than 52% in the past 24 hours, as has social interaction.

However, some coin indicators still maintain a positive trend.

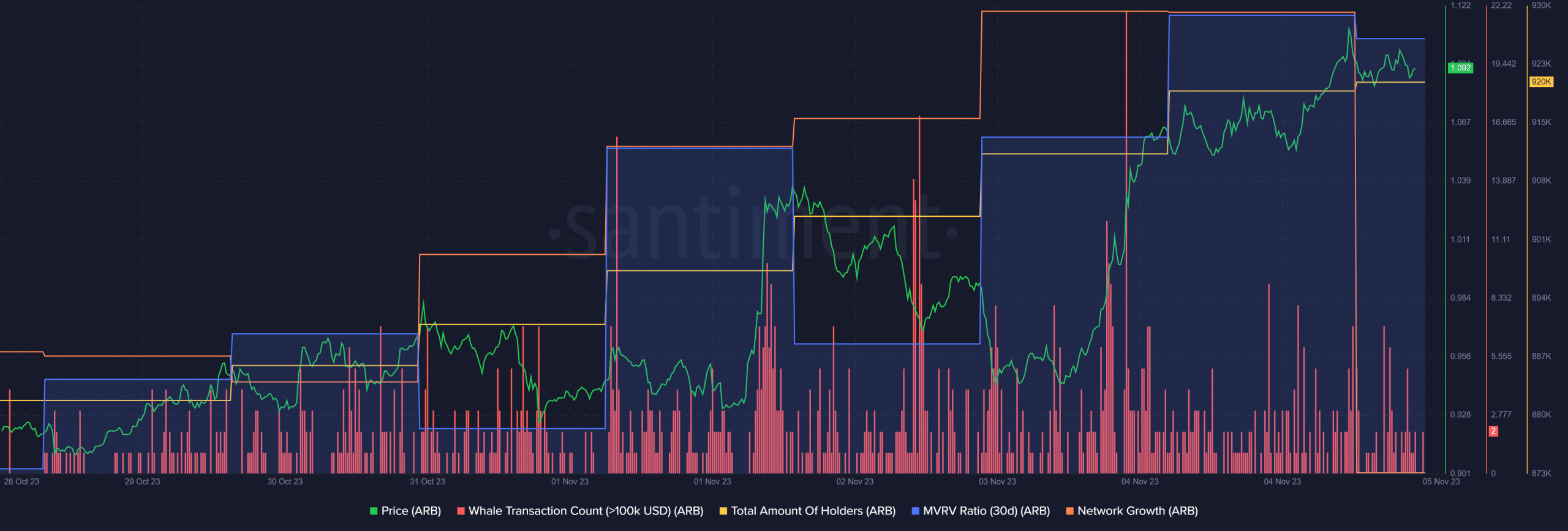

For example, Arbitrum’s AltRank has been improved, which enhances the token’s potential for continued price appreciation. Not only that, the MVRV ratio of the token has also increased significantly. Its network growth remains high, which means many new addresses are created to trade coins.

Major investors and owners also have growing confidence in ARB. This is evident from the increase in the number of transactions by large investors and the increase in the total number of holders over the past week.

The future of arbitration

Relative Strength Index (RSI) arbitration has entered overbought territory, which could create selling pressure on ARB and push the price lower. Another negative analysis tool is ARB’s Bollinger Bands.

The tool shows that ARB price has hit its upper limit, raising the possibility of a trend reversal. However, MACD is showing a clear bullish advantage in the market. The Chaikin Money Flow Index (CMF) was also updated, suggesting there is further upside potential.

information Bitcoin Synthetic

[ad_2]

Source link