Take stock of 20 active Bitcoin ETF spot funds in the world, with a total value of up to US$4.16 billion

[ad_1]

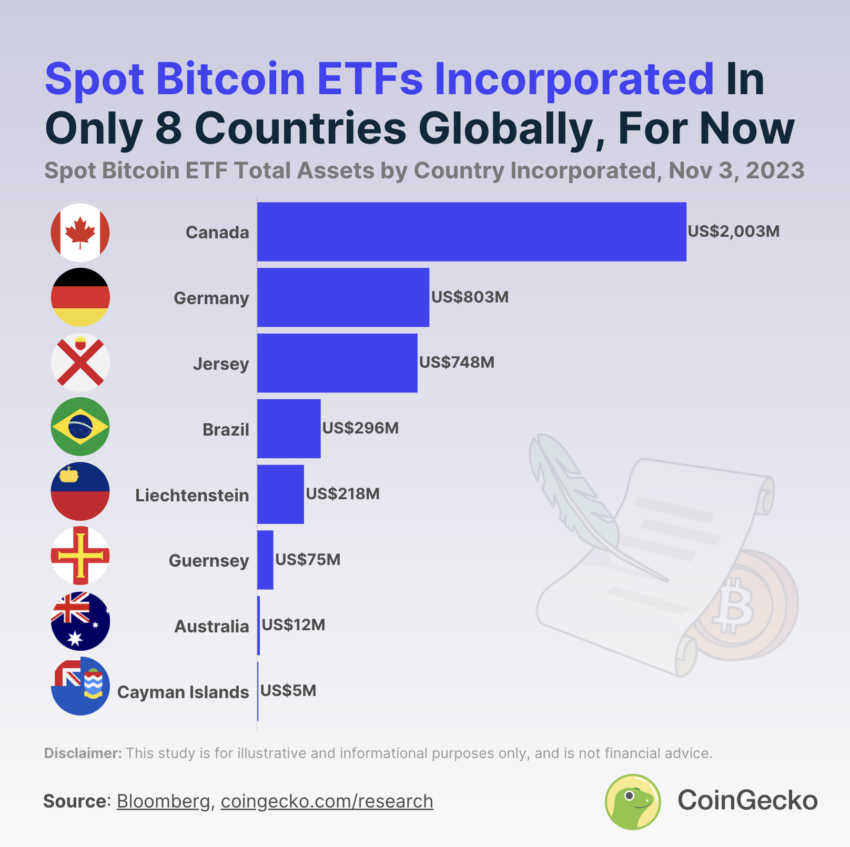

The emergence of Bitcoin ETF spot is gradually changing the entire cryptocurrency industry, with total global assets reaching US$4.16 billion.

The latest data shows that global assets invested in Bitcoin ETF spot US dollars reached US$4.16 billion.

This is evidence of the growing acceptance of these innovative financial instruments, which offer both retail and institutional investors a “safe” route into Bitcoin.

20 Bitcoin ETF spot funds around the world

Canada is a pioneer in this field, issuing 7 Bitcoin ETF spot funds with a total investment capital of US$2 billion. This is a sign of Canada’s progressive stance on incorporating cryptocurrencies into its financial ecosystem.

Europe, led by Germany, has also demonstrated a more open regulatory approach. ETC Group physical BBitcoin (BTCE.DE) was launched in June 2020 and currently has assets worth approximately $802 million, making it the second largest Bitcoin ETF spot in the world. Additionally, seven other European ETFs are registered in tax-advantaged jurisdictions, further strengthening Europe’s growing crypto-friendly ecosystem.

Bitcoin spot ETFs are active globally. Source: CoinGecko

As of now, only 8 countries in the world accept Bitcoin ETF spot, including:

- Canada,

- virtue,

- Brazil,

- Australia,

- jersey,

- Liechtenstein,

- guernsey,

- Cayman Islands.

The global distribution of Bitcoin ETF spots paints a vivid picture of how countries position themselves in the cryptocurrency market.

Contrary to the above-mentioned friendly countries, the United States still maintains a “conservative” stance. The U.S. Securities and Exchange Commission (SEC) has only approved ETFs related to Bitcoin futures, such as ProShares Bitcoin Strategy, which leads the way with about $1.2 billion in assets.

US approves Bitcoin ETF spot?

While as many as 10 Bitcoin ETF spot applications are awaiting approval, SEC concerns about market manipulation remain a significant hurdle. As a result, the SEC keeps delaying its decision.

![]() Bitcoin ETF Spot Application Checklist and SEC Approval Deadline

Bitcoin ETF Spot Application Checklist and SEC Approval Deadline

However, debate over the U.S.’s approval of a spot Bitcoin ETF is heating up, as experts predict the fund could unlock billions of dollars in flows from traditional finance into the cryptocurrency market.

“Once these ETFs are approved, we expect $155 billion to flow into the Bitcoin market. The total assets under management (AUM) of these companies is approximately $15.6 trillion. If they put 1% of their AUM into Bitcoin spot ETFs, Approximately $155 billion will flow into the Bitcoin market. This amount is equivalent to nearly one-third of Bitcoin’s current market value.”

Excerpted from blockchain analysis platform CryptoQuant

Looking ahead, the SEC’s decision on the pending Bitcoin spot ETF could be a turning point. Therefore, it is possible to start a new chapter in the cryptocurrency industry.

“We expect the ETF to receive SEC approval in late 2023 or Q1 2024, marking a major turning point for cryptocurrencies. Post-halving, we expect Bitcoin spot demand for the ETF to be higher than peak miner sales 6-7 times. Meanwhile, by 2028, Bitcoin ETFs will be equivalent to 9-10% of the Bitcoin spot in circulation.”

Gautam Chhugani, Senior Global Digital Analyst, Bernstein

VIC encryption compilation

related news:

![]() What does the approval of a Bitcoin ETF spot mean for the entire crypto industry?

What does the approval of a Bitcoin ETF spot mean for the entire crypto industry?

![]() BlackRock’s iShares Bitcoin ETF mysteriously disappeared and suddenly reappeared in DTCC

BlackRock’s iShares Bitcoin ETF mysteriously disappeared and suddenly reappeared in DTCC

![]() The search volume of the keyword “Bitcoin ETF spot” on Google has reached its peak

The search volume of the keyword “Bitcoin ETF spot” on Google has reached its peak

[ad_2]

Source link