Demystifying Private Equity Fund Structures 2023

Private Equity Fund Structures is a dynamic and influential asset class that has gained substantial prominence in the world of finance. Private equity funds play a pivotal role in the functioning of this industry, and understanding their structures is crucial for investors, entrepreneurs, and anyone interested in this sector. In this in-depth exploration of private equity fund structures, we will unravel the complexities, delve into the key components, and provide insights into how these structures work.

I. The Basics of Private Equity

Before we dive into the intricacies of private equity fund structures, let’s establish a solid foundation by defining the basics.

- What is Private Equity?Private Equity Fund Structures

Private equity (PE) refers to investments made in private companies or enterprises that are not publicly traded. PE firms raise capital from a variety of sources, including institutional investors, high-net-worth individuals, and pension funds, to invest in private companies with the aim of achieving substantial returns.

- The Role of Private Equity Funds Private Equity Fund Structures

Private equity funds act as the intermediaries that channel capital from investors to private companies. They play a crucial role in the private equity industry by facilitating the investment process, managing the assets, and ensuring that the interests of all stakeholders are aligned.

II. Understanding Private Equity Fund Structures

The structure of a private equity fund is fundamental to its operation and determines how the capital is managed, how returns are distributed, and the level of control investors have over their investments.

- Legal Structure Private Equity Fund Structures

Private equity funds can be structured in various ways, but the most common legal structures include:

a. Limited Partnership (LP): In an LP structure, there are general partners (GPs) who manage the fund and limited partners (LPs) who provide capital. LPs have limited liability, and GPs have management responsibilities.

b. Limited Liability Company (LLC): Some private equity funds are organized as LLCs. This structure provides more flexibility in terms of management and tax considerations.

- Capital Commitment Private Equity Fund Structures

Investors in private equity funds commit to providing capital over a specified period. This capital commitment is not immediately called upon but can be drawn down by the fund as needed to make investments.

- Investment Period Private Equity Fund Structures

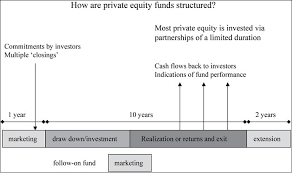

Private equity funds typically have a defined investment period during which they actively seek and make investments in various companies. This period can vary depending on the fund’s strategy and can range from 3 to 7 years.

- Fund Life Private Equity Fund Structures

The fund life is the duration for which the fund is expected to be in existence. It encompasses the investment period, the holding period for investments, and the exit period. The typical fund life is around 10 to 15 years, but it can vary.

Loving Travel

- Investment Strategies Private Equity Fund Structures

Private equity funds employ different investment strategies, such as:

a. Buyout Funds: These funds acquire controlling stakes in existing companies, aiming to improve their performance and ultimately sell them for a profit.

b. Venture Capital: Venture capital funds focus on early-stage companies with high growth potential.

c. Growth Equity: Growth equity funds invest in established companies to support their expansion and growth initiatives.

d. Distressed Debt: These funds specialize in investing in financially troubled companies or their debt.

How to Score the Hottest Bad Bunny Tickets: Tips, Tricks, and Insider Insights

III. The Fund’s Structure and Key Components

To comprehend the internal workings of private equity funds, let’s delve into the core components of their structure.

- General Partners (GPs)

General partners are the fund managers responsible for sourcing, evaluating, and executing investment opportunities. They also oversee the day-to-day operations of the fund. GPs typically invest their own capital in the fund and earn management fees and carried interest as compensation.

- Limited Partners (LPs)

Limited partners are the investors who provide capital to the fund. They have limited liability, meaning their financial exposure is limited to the amount they committed. LPs include institutional investors, pension funds, endowments, and high-net-worth individuals.

- Management Fees

GPs receive management fees, typically a percentage of the fund’s total committed capital, to cover the operational costs of the fund. These fees are paid regardless of the fund’s performance and are essential for maintaining the fund’s infrastructure.

- Carried Interest

Carried interest, also known as the “carry,” is the share of profits that GPs receive once a certain return threshold is reached. Typically, GPs receive around 20% of the fund’s profits after investors have received their initial capital back (known as the “hurdle rate”).

- Hurdle Rate

The hurdle rate is a predetermined rate of return that must be achieved before GPs can start earning carried interest. It ensures that GPs are incentivized to generate substantial returns for the LPs.

- Investment Period

During the investment period, GPs actively seek and make investments in target companies. This period allows the fund to deploy capital and build its portfolio.

- Portfolio Companies

Portfolio companies are the businesses in which the private equity fund invests. GPs work to enhance the value of these companies through operational improvements, strategic direction, and other means.

- Exit Strategies

The ultimate goal of a private equity fund is to realize returns on investments. Common exit strategies include selling portfolio companies through initial public offerings (IPOs), mergers and acquisitions (M&A), or secondary buyouts.

IV. Variations in Private Equity Fund Structures

Private equity fund structures are not one-size-fits-all; they can vary significantly based on the fund’s strategy, size, and specific investor requirements. Let’s explore some of the common variations:

- Fund Size

Private equity funds come in various sizes, ranging from small boutique funds to large, multi-billion-dollar institutions. The fund’s size impacts its investment scope, resources, and management requirements.

- Geographical Focus

Some private equity funds specialize in specific geographic regions, while others have a global investment mandate. Funds with a regional focus may have a deeper understanding of local markets and industries.

- Industry Focus

Certain private equity funds concentrate on specific industries, such as healthcare, technology, or energy. These industry-focused funds can offer specialized expertise and networks in their chosen sectors.

- Co-Investment Opportunities

Some private equity funds provide co-investment opportunities, allowing LPs to invest directly alongside the fund in specific transactions. Co-investments can enhance an investor’s exposure and potentially reduce fees.

- Evergreen Funds

While most private equity funds have a fixed lifespan, some operate as evergreen funds. Evergreen funds do not have a predefined end date and can continue to make investments and manage assets indefinitely.

- Fund-of-Funds

Fund-of-funds (FoFs) are a type of private equity fund that invests in multiple underlying private equity funds. This structure allows investors to gain exposure to a diversified portfolio of private equity investments.

V. The Fund Lifecycle

Understanding the lifecycle of a private equity fund is essential for investors and stakeholders. It involves distinct stages, from fund formation to liquidation.

- Fund Formation

The formation stage includes establishing the fund’s legal structure, developing the investment strategy, and securing commitments from LPs. This phase can take several months or even years.

- Capital Raising

Once the fund is established, GPs begin raising capital from LPs. The capital commitment from investors forms the fund’s initial pool of assets.

- Investment Period

During the investment period, the fund actively seeks and makes investments in target companies. The goal is to build a diversified portfolio and maximize returns.

- Active Management

After acquiring portfolio companies, GPs engage in active management. This phase involves implementing operational improvements, making strategic decisions, and overseeing day-to-day operations.

- Exit Strategies

GPs work toward realizing returns by executing exit strategies, which can include selling portfolio companies through IPOs, M&A, or other means. The timing and success of exits significantly impact returns.

- Distribution of Returns

As portfolio companies are sold and profits are generated, the returns are distributed to LPs, GPs, and other stakeholders according to the fund’s structure and the priority of claims.

- Fund Liquidation

Upon reaching the end of the fund’s life, the fund is liquidated, and any remaining assets are distributed to the investors. This marks the conclusion of the fund’s lifecycle.

VI. Challenges and Considerations

While private equity offers substantial benefits, it also presents challenges and considerations for investors and stakeholders.

- Illiquidity

Private equity investments are typically illiquid, meaning that capital is tied up for an extended period. Investors must be prepared for a long-term commitment.

- Risk and Volatility

Private equity investments carry risks, including market risk, operational risk, and company-specific risk. It’s crucial for LPs to assess the risk-return profile of the fund.

- Due Diligence

Investors must conduct thorough due diligence when evaluating private equity funds. This includes assessing the fund’s track record, strategy, and the experience of the GP team.

- Fees and Expenses

Understanding the fee structure of the fund, including management fees and carried interest, is essential for investors. High fees can erode returns over time.

- Regulatory Compliance

Private equity funds must comply with regulatory requirements, which can vary by jurisdiction. Staying compliant is critical to the fund’s operations.

VII. The Future of Private Equity Fund Structures

The landscape of private equity is continuously evolving, and future developments in fund structures are expected. Some trends and predictions for the future include:

- ESG Integration

Environmental, Social, and Governance (ESG) considerations are becoming increasingly important in private equity. Funds are likely to integrate ESG factors into their investment decisions and strategies.

- Technology Adoption

Private equity funds are expected to adopt advanced technologies, such as artificial intelligence and data analytics, to enhance investment decision-making and portfolio management.

- Secondary Markets

The secondary market for private equity interests is growing, allowing investors to buy and sell stakes in existing private equity funds. This can provide liquidity options for investors.

- Co-Investment Opportunities

The popularity of co-investment opportunities is expected to rise, allowing LPs to have more direct involvement in specific transactions and potentially reduce fees.

Conclusion

Private equity fund structures are the backbone of the private equity industry, and understanding their intricacies is vital for anyone interested in this asset class. From legal structures to investment strategies and the fund lifecycle, private equity funds offer diverse options for investors and stakeholders. While challenges and considerations exist, the potential for significant returns and long-term benefits makes private equity a compelling investment choice in the world of finance. As this industry continues to evolve, staying informed about the latest developments and trends is crucial for making informed investment decisions in the world of private equity.