BRC-20, Ordinals prepare for resurrection: BTC transaction fees hit new highs

[ad_1]

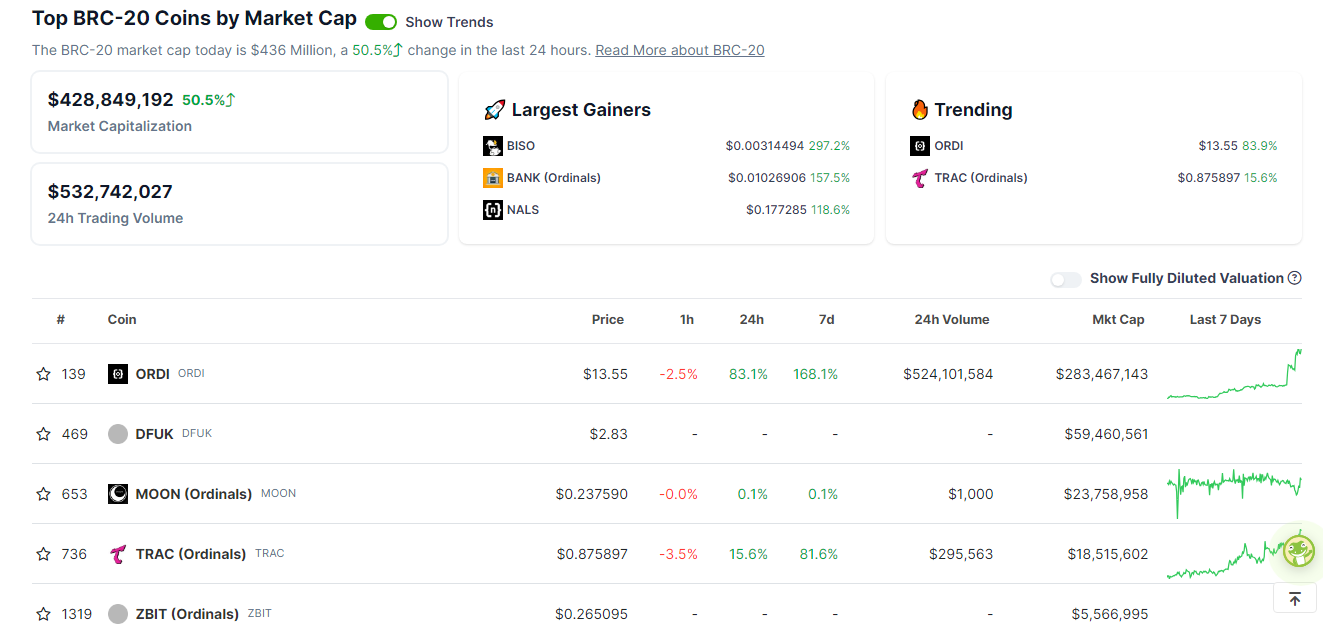

In recent days, there have been many signs of breakthroughs in the on-chain data of BRC-20 tokens, and the market value has also increased significantly by 50% in the past 24 hours.

On November 7th, Binance surprises Listing notice Serial number (ORDI). Soon after, the price of this token and many other BRC-20 tokens increased dramatically. Not only that, but the size of capital as well as the volume and number of transactions have also increased. This got the community excited and they started thinking: “Is BRC-20 resurrected?”

BRC-20 system token shows signs of attracting cash flow

Currently, the market value of BRC-20 reaches US$429 million, an increase of more than 50% in the past 24 hours. This sudden increase is a sign of money flowing into the BRC-20 system.

Overview of BRC-20 token market transaction data. source: Coingeco

It is worth noting that Ordinals (ORDI) alone has a 24-hour trading volume of over $524 million, accounting for the majority of the total BRC-20 market trading volume. ORDI also recorded an increase of more than 168% last week, and has increased four times in the past month. It can be seen that ORDI’s growth is due to being listed on Binance.

In addition to ORDI, although other BRC-20 tokens have also seen significant gains in the past 7 days, such as TRAC up 81%, NALS up 138%, SATS up 530% or PIZA up 404%, the trading volume has been low, compared Dismal, only 1 million to 2 million US dollars.

Trading volume is too low, leaving many investors hesitant. However, in the BRC-20 token list, most are projects with extremely low liquidity, with only tens of thousands of dollars, or even no liquidity.

BTC transaction fees soar

After a quiet period when BRC-20 seemed to have fallen out of favor, who would have thought that in November this year, along with the rising momentum of the market, the number of BRC-20 transactions would suddenly increase again. This resulted in the highest increase in Bitcoin transaction fees since May 2023.

Bitcoin transaction fees. source: bit infographic

Specifically:

- Nearly 1 million mintage serial numbers have been blocked in the past seven days, and serial number inscriptions have clogged Meempool, with more than 136,809 transactions unconfirmed.

Overview of Bitcoin mempool data. source: memory pool space

- Average transaction fees soared to nearly $7.

- According to data from Dune, the total number of BRC-20 transactions exceeded 400,000 on one day in November this year, returning to a new high in 2023.

.png)

BRC-20 transaction volume on the Bitcoin network. Source: Dune/@Cryptokoryo

In the current situation of skyrocketing fees, miners may be the ones who benefit the most. According to Glassnode’s on-chain data, 8.5% of the revenue miners received came from this fee increase on November 6 – the largest daily percentage since early June.

Now, due to the positive impact brought by ORDI, the community is beginning to expect funds to flow into BRC-20 tokens. But overall, trading these coins is still an extremely risky business.

VIC encryption compilation

related news:

![]() Instructions for minting BRC-20 tokens on the Ordinals wallet

Instructions for minting BRC-20 tokens on the Ordinals wallet

![]() Find instructions for BRC-20 betting using UniSat Wallet “Follow the Trend”

Find instructions for BRC-20 betting using UniSat Wallet “Follow the Trend”

![]() What are BRC-20 tokens?Uncovering the truth about the latest trends in the cryptocurrency ecosystem

What are BRC-20 tokens?Uncovering the truth about the latest trends in the cryptocurrency ecosystem

![]() Bitcoin Token Standard BRC-20 Becomes New Destination for Meme Coins

Bitcoin Token Standard BRC-20 Becomes New Destination for Meme Coins

[ad_2]

Source link