Ripple CLO raises concerns over series of SEC failures targeting cryptocurrencies

[ad_1]

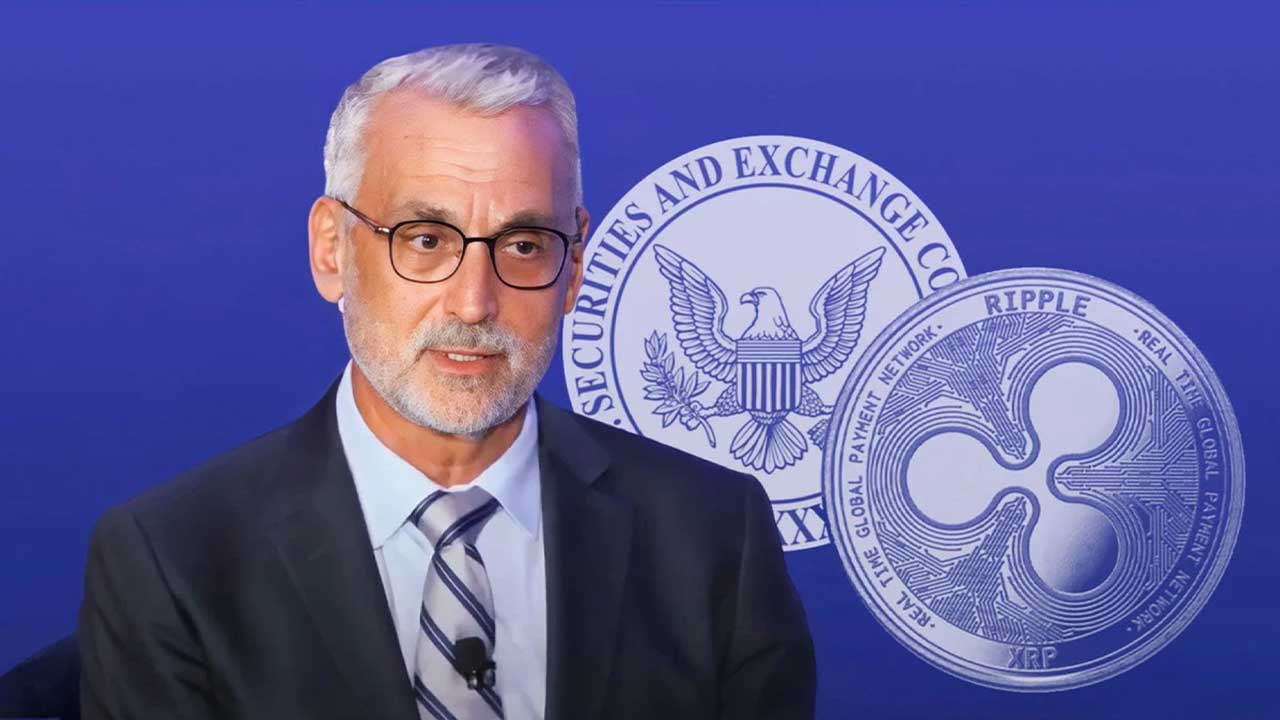

Ripple CLO Stuart Aldrottiexpressed concern about the U.S. Securities and Exchange Commission’s recent record of failed legal proceedings against cryptocurrency companies, as many members of the cryptocurrency community appear to doubt the regulator’s core mission of protecting investors.

Ripple CLO opens up about series of SEC failures

Stuart Alderoty, Chief Legal Officer rippleThe leading cryptocurrency solutions provider posted on X (formerly Twitter) to express concerns over recent regulatory failures by the U.S. Securities and Exchange Commission (SEC) in cases involving the cryptocurrency industry.

Aldrotti said in the post that the series of failures at the SEC are becoming concerning.

He highlighted a recent SEC lawsuit that was dismissed by a court that ruled the SEC’s actions were “arbitrary.”

“Another day, another court finding that the SEC has once again acted arbitrarily and capriciously. Is anyone else concerned about this very disturbing pattern of the SEC disregarding its allegiance to the rule of law under Mr. Gensler’s leadership?

The SEC has been involved in numerous lawsuits against cryptocurrency exchanges and companies over the years. One of the most prominent and ongoing cases is the legal battle against XRP, Binance Grayscale files lawsuit against SEC after SEC rejects Spot’s application Bitcoin ETF.

The regulator filed a lawsuit against XRP in December 2020. The three-year battle has had a series of ups and downs, with the SEC facing significant losses after Judge Analisa Torres ruled that selling XRP tokens under the scheme did not violate federal securities laws.

Additionally, regulators have recently run into trouble after trying to introduce regulations requiring U.S. companies to provide more detailed and personal information about stock buybacks.

In response, the Fifth District Court of Appeals struck down the rule, saying its adoption was unreasonable and that the SEC should withdraw and reconsider the rule.

The court stated:

“The SEC acted in an arbitrary and capricious manner in violation of the APA, without responding to petitioners’ comments and without conducting a proper cost-benefit analysis.”

Ripple’s update on XRP and SEC

Ripple recently released its new quarterly XRP market report on Wednesday. The report reveals the current status of the legal battle between the US SEC and XRP.

According to the XRP Markets third quarter report, cryptocurrency scams, scams, and protocol hacks have increased, with approximately $686 million lost in the third quarter.

Additionally, major U.S. cryptocurrency exchanges profited from listing XRP following Judge Torres’ ruling on programmatic sales.

Reports show that XRP transaction volume on the XRP ledger has been growing steadily, more than tripling in the third quarter.

However, the parties have yet to reach a settlement agreement regarding the SEC’s dismissal of the charges against Ripple CEO Brad Garlinghouse and Ripple co-founder Chris Larsen.

The popular crypto payments company announced in an

Ripple said:

“We publish the XRP Market Report to provide transparency and provide regular updates on the company’s view on key industry developments and cryptocurrency market developments, focusing on relevant breaking news XRPL and Ripple”.

Bitcoin News Synthetic.

[ad_2]

Source link