Bitcoin mục tiêu 40.000 USD khi FOMC giữ nguyên lãi suất

[ad_1]

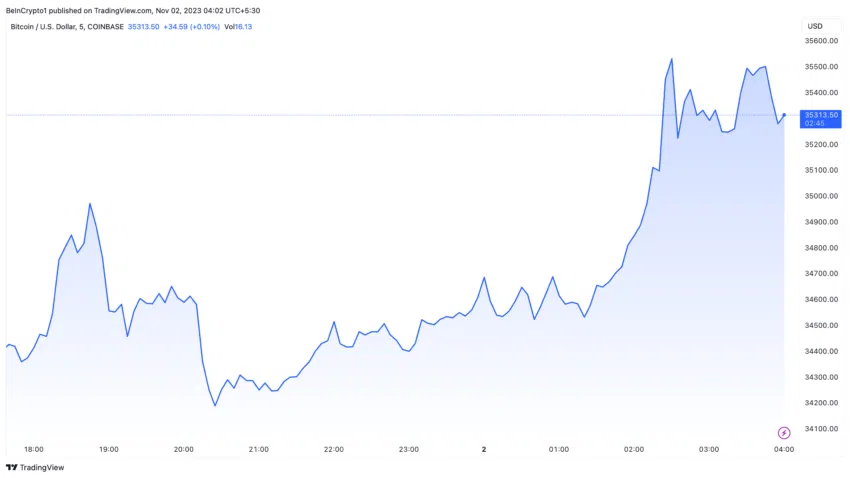

Inspired by the Federal Open Market Committee’s (FOMC) recent decision to keep interest rates on hold, Bitcoin has a price target of $40,000. Markets were boosted as the Federal Reserve stepped up its strategy of keeping the federal funds rate at around 5.25% – 5.50%.

The move, while expected, caused turmoil in financial markets and gave investors and traders in the industry a boost. cryptocurrency.

Bitcoin surges as Fed extends rate pause

Interest rate balance creates favorable conditions for economic development Bitcoin Reclaim your power. On-chain analyst Ibrahim Ajibade said this could help Bitcoin confidently move toward the $40,000 mark.

“Judging from historical data, 79% of Bitcoin holders are profitable, and the overall situation of the ecosystem is currently improving…Based on these data trends, if the interest rate suspension is announced, the Bitcoin price is likely to continue to rise to the $40,000 mark “Officially announced,” Ajibade said.

For Bitcoin, this renaissance is more than just a journey. The altcoin industry is also experiencing a strong recovery, Solana(SOL) Leading the way, with an increase of 16%. Likewise, Avalanche (AVAX), polka dot (point) and Near Agreement (NEAR) rose 6% to 10%.

The Federal Reserve’s (FED) statement, coupled with comments from Fed Chairman Jerome Powell that the initial balance rollback would remain in place, injected mild optimism. However, as Ajibade predicted, the cryptocurrency market reacted positively as the Federal Reserve extended its pause on rate hikes.

Federal Open Market Committee (FOMC) Strong Commitment to Control Inflation It reassured the market while ensuring maximum employment. The Fed’s vigilance against inflation risks and its ability to flexibly adjust monetary policy are critical to maintaining market confidence.

“Tight financing and credit conditions for households and businesses could affect economic activity, employment, and inflation. The magnitude of this impact remains uncertain. The Committee continues to monitor inflation risks closely,” the FOMC statement said.

As the stock market closed on a strong note, with both the S&P 500 and Nasdaq 100 registering sharp gains, the cryptocurrency market also thrived amid favorable economic conditions. The 10-year U.S. Treasury yield fell to 4.73% from a high of nearly 5% at the beginning of the week, reducing the possibility of raising interest rates. Therefore, increasing Bitcoin’s appeal is a defensive tool against broad monetary policy.

With the Federal Reserve’s determination to adjust monetary policy and its vigilance on economic indicators, the market is expected to usher in a period of stable growth. The situation has Bitcoin on track to hit new highs this year, with the $40,000 target firmly in sight.

Bitcoin News Synthetic

[ad_2]

Source link